tax sheltered annuity vs 401k

However you contribute to annuities with after-tax dollars while you contribute to traditional 401ks with pre-tax dollars. A 403 b plan is tax-advantaged and employer-sponsored.

401k Alternatives 10 Potential Different Options Personal Capital

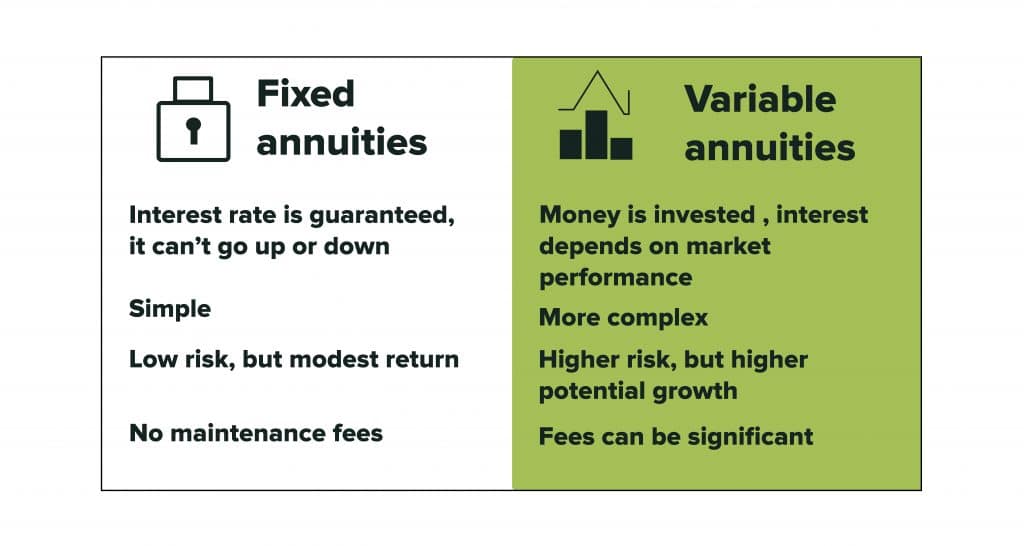

Fixed and Variable Annuity are the two main types of Annuity.

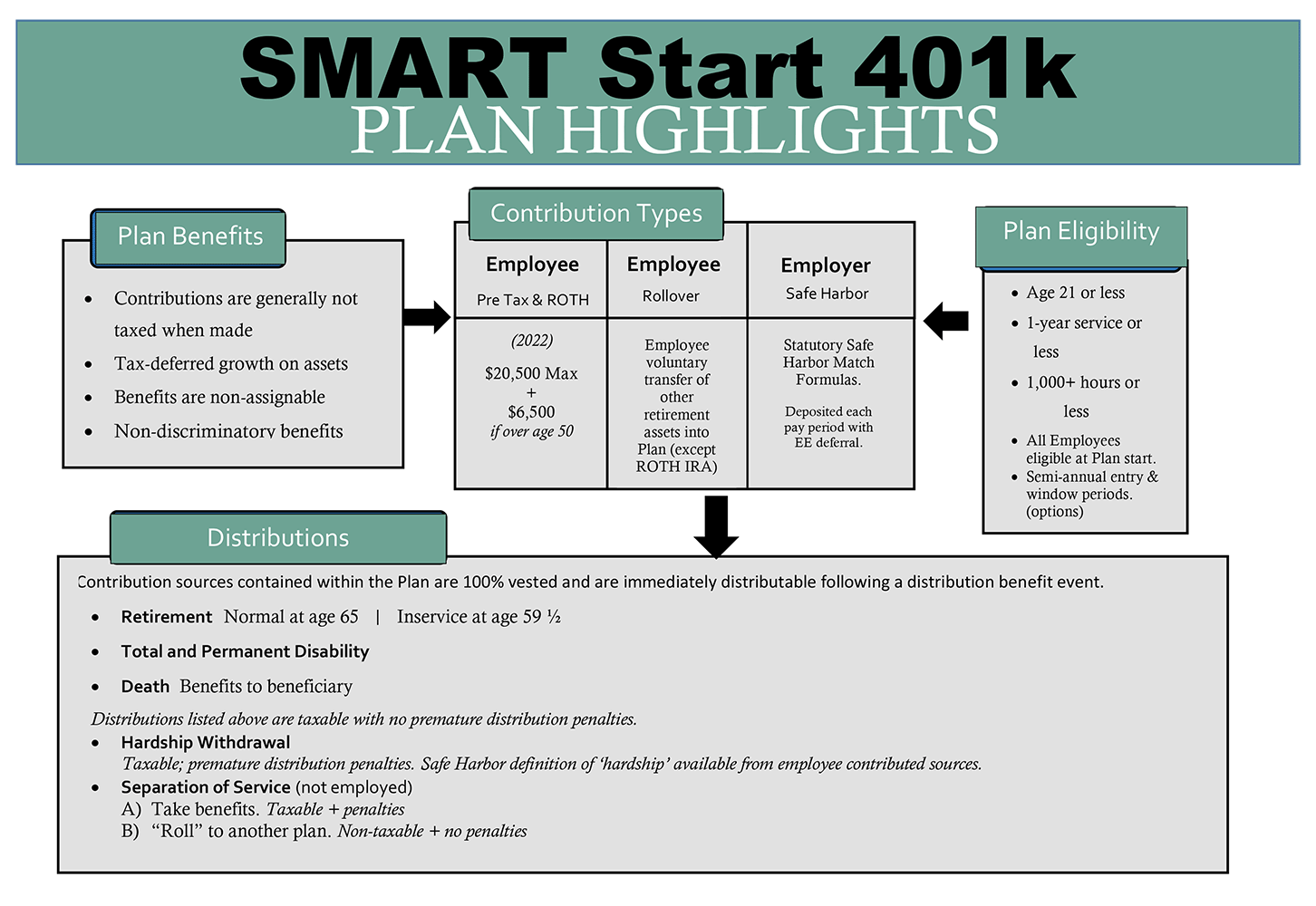

. Both annuities and 401ks provide a tax-sheltered way to save for retirement. Its similar to a 401 k plan maintained by a for-profit entity. A 403 b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities.

A 403b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501c3 tax-exempt. So whats the difference. Just like 401 k plans the 403 b plan is named after a specific section of the tax code that describes it.

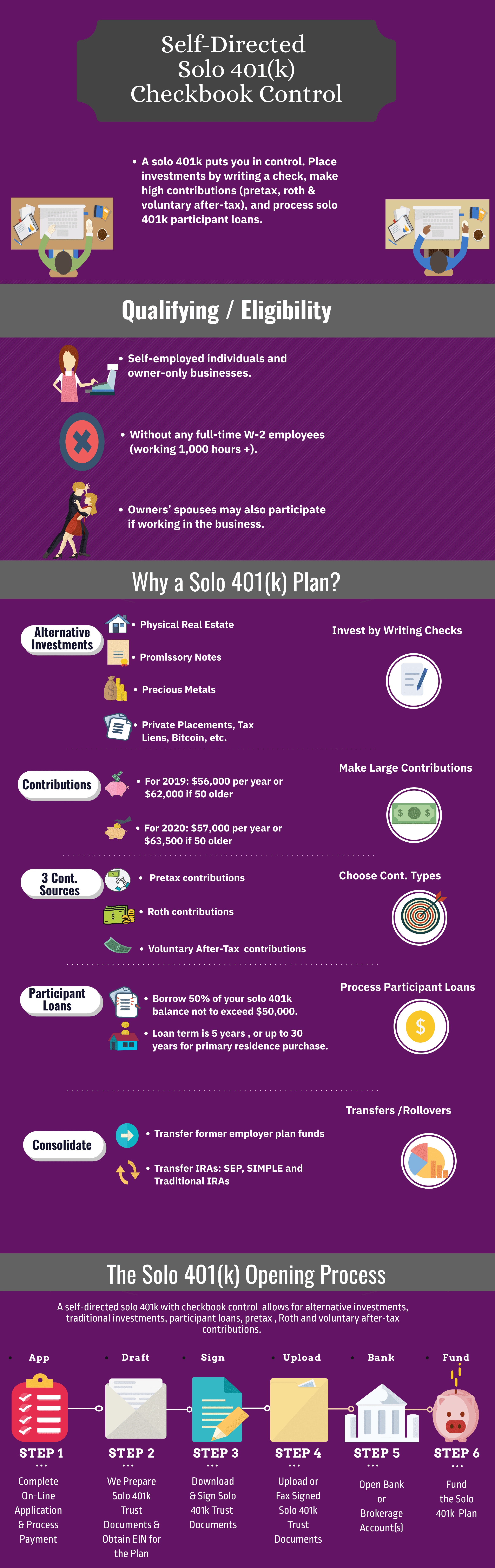

People use their 401 k to accumulate and hopefully grow their money for. A 403 b plan is also another name for a tax-sheltered annuity plan and the features of a 403 b plan are comparable to those found in a 401 k plan. Although 401 k plans are the most popular an alternative known as a tax-sheltered annuity or TSA plan is available to many workers especially in the nonprofit world and.

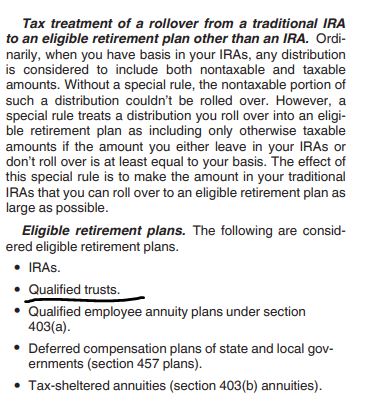

You will not owe income taxes on the investment returns of a 401k or annuity until you withdraw. A tax-sheltered annuity TSA is a retirement savings plan that allows employees to invest pre-tax dollars in an account to build retirement income. The most glaring difference is the fact that you choose annuity as a financial product from an insurance company while 401k is a retirement plan offered by your employer.

401k contributions are invested in securities--normally mutual funds--and the employee is responsible for choosing the ones to invest in. However a traditional 401k is already tax-sheltered and a delayed rollover could cost you in taxes. When its time to withdraw money in retirement you will.

Just as with a. One good way to grasp the difference between a 401 k and annuity is to understand how people use them. An annuity can be jointly owned and can be purchased by.

According to the IRS a 403b plan or tax-sheltered annuity TSA differs from a 401k in that it can only be offered by public schools and certain tax-exempt organizations. There are no types of 401k accounts. Key Takeaways Annuities can come with a host of fees and charges that.

Solo 401k Faqs My Solo 401k Financial

Financial Professionals Nexus Administrators

Retirement Plan Maximum Contributions And Tax Deductions

403b Retirement Plans Fisher 401 K

Difference Between 401k And 403b Retirement Plans

A Tax Deferred Annuity 101 Guide For Non Biased Consumers Due

Solo 401k Faqs My Solo 401k Financial

Should I Rollover My Ira Or 401 K Into An Annuity

Annuity Vs 401k Comparing The Risk And Benefits

403b Vs 401k Here S The Difference Arrest Your Debt

Cno Financial Group On Twitter Do You Know The Difference Between An Annuity An Ira And A 401k During Annuity Awareness Month Learn How To Distinguish Between Each Of These Retirement Tools

All The Difference Between 403b And 401k Plans You Should Know About Financial Digits

401 K And 403 B Retirement Plans Vestwell

Retirement Accounts A Comprehensive Guide Meld Financial

Stocks Part Viii The 401k 403b Tsp Ira Roth Buckets Jlcollinsnh

Pension Vs 401 K Forbes Advisor