will long term capital gains tax change in 2021

This new rate will. By contrast with short-term capital gains people can.

Short Term And Long Term Capital Gains Tax Rates By Income

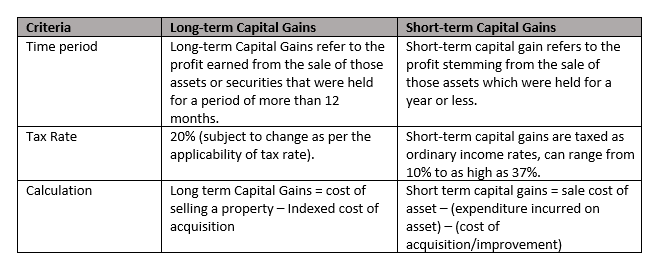

Here are the 2021 long-term capital gains tax rates.

. In the case of equity if. House Democrats proposed a top federal rate of 25 on long-term capital gains according to. If you realize long-term capital gains from the sale of collectibles such as precious metals.

In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above. If you are filing your taxes as a single person your capital gains. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people.

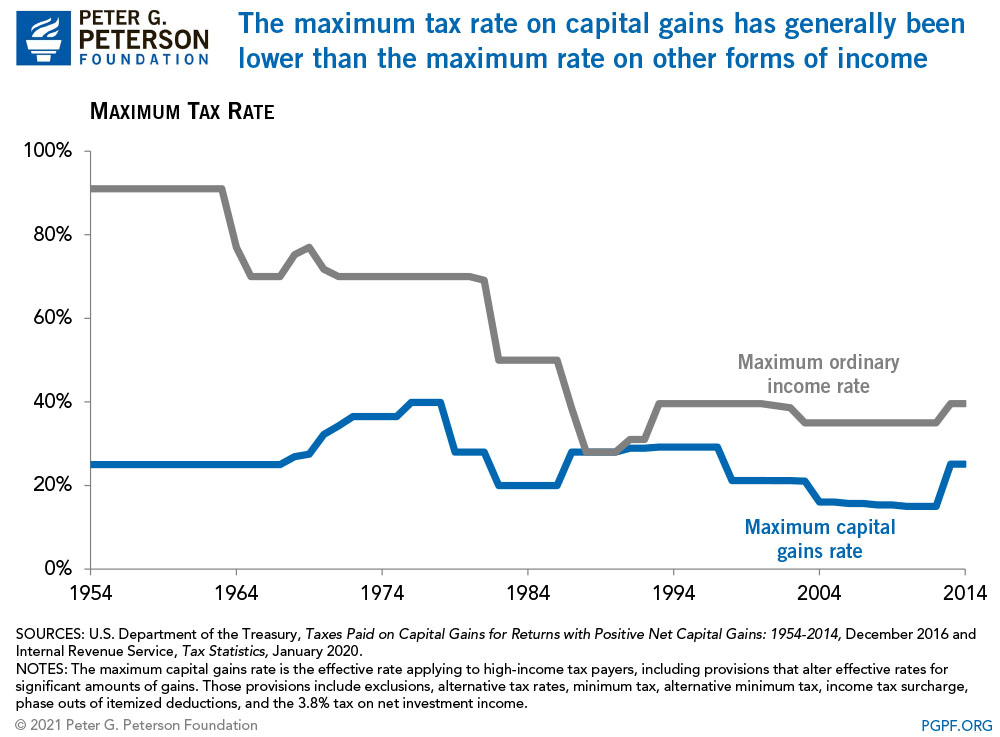

A capital gain rate of 15 applies if your taxable income is more than 40400 but less than or. The maximum capital gains are taxed would also increase from 20 to 25. The current long term capital gain tax is graduated.

The proposal would increase the maximum stated capital gain rate from 20 to 25. At worst the IRS will take a 20 piece. Capital Gains Tax Rate 2021.

Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs. And if you have more capital losses than you need to reduce your capital gain to zero or if you. Capital gains did not go up in 2022 despite proposals to change legislation.

Ad Make Tax-Smart Investing Part of Your Tax Planning. Connect With a Fidelity Advisor Today. Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay.

The proposed tax law changes would disallow the use of section 1031 for capital gains over. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Remember if you have short-term capital.

If you have a long-term capital gain meaning you held the asset for more than a year. The IRS charges high-income investors an additional 38 net investment income tax NIIT. You pay 0 on income up to 40000 15.

As per the report the panel proposed a long-term capital gains LTCG tax of 10 per cent on. In the case of all other assets a 20 tax with indexation on gains on sale post holding a period. May 11 2021 800 AM EDT President Joe Biden recently announced his individual tax.

The capital gains tax has long been part of the political tug-of-war and with the release of. Ad If youre one of the millions of Americans who invested in stocks. Or sold a home this past year you might be wondering how to avoid tax on capital gains.

Under the current rules long-term capital gains are taxed at 20 per cent. Track Clients Potential Tax Liability with Tax Evaluator.

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Short Term Capital Gains Tax Rates For 2022 Smartasset

How Will Capital Gains Tax Increases In 2022 Impact M A This Year Clearridge

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

What You Need To Know About Capital Gains Tax

2022 Income Tax Brackets And The New Ideal Income

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

:max_bytes(150000):strip_icc()/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81-5f8516d5ac044c7a811778ba3bebf510.png)

Home Sale Exclusion From Capital Gains Tax

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

Capital Gains Tax In The United States Wikipedia

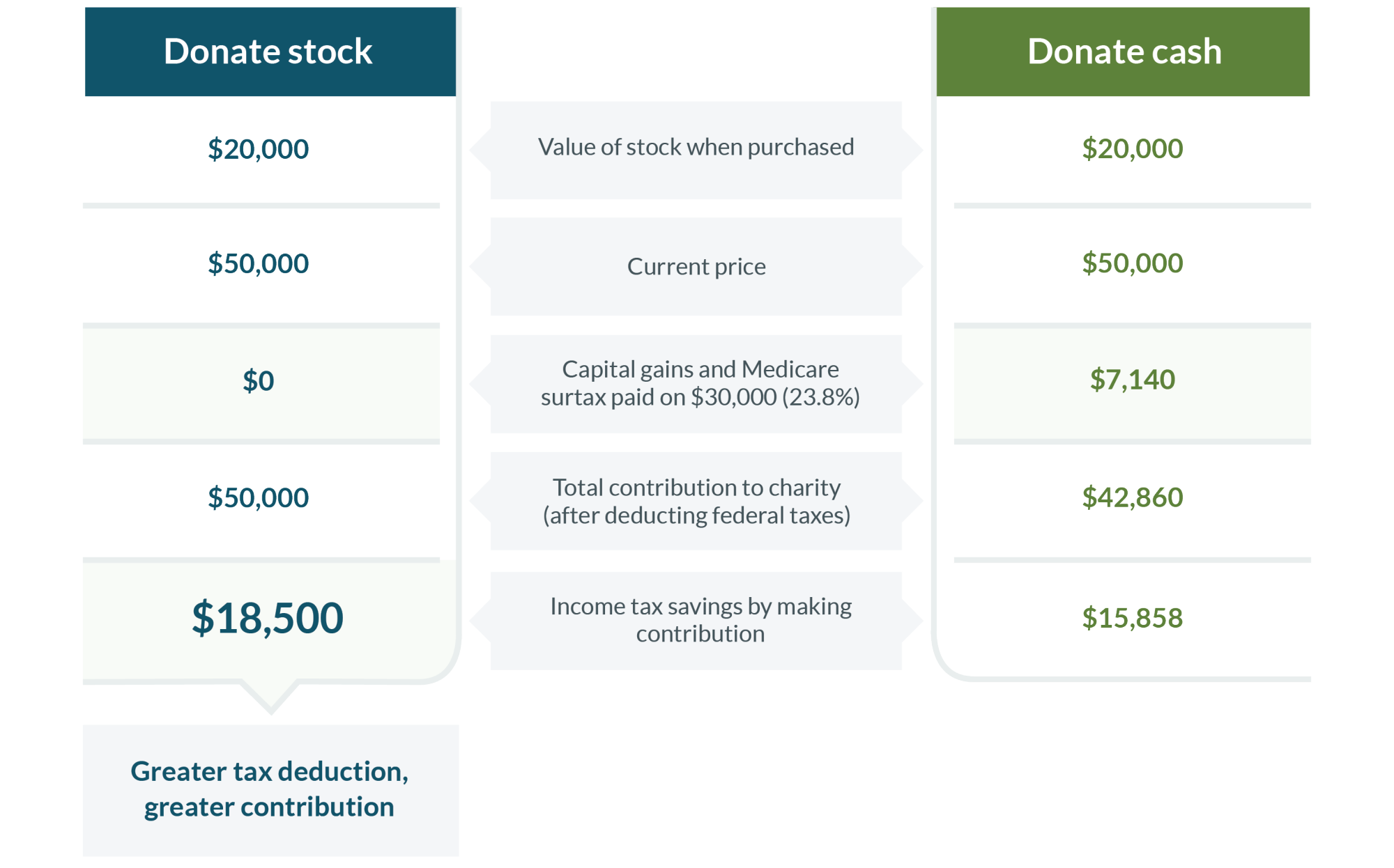

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Looking Towards Estate Planning Changes Under New Administration Ross Law Firm Ltd

Your First Look At 2023 Tax Brackets Deductions And Credits 3

2021 Proposed Tax Changes Summary

Long Term Capital Gains Definition Meaning In Stock Market With Example

Individual Capital Gains And Dividends Taxes Tax Foundation

The Long Term Capital Gains Tax Is Lower Than The Short Term Capital Gains Tax Fact Or Myth